What is the benefit of blockchain in estate?

1. Security

Blockchain’s immutability safeguards data in the system, making it challenging for anyone to alter stored information. This feature ensures the authenticity of property documents, fostering trust in real estate transactions.

2. Improved Transaction Speed

Traditional large payments for properties through centralized banks can be cumbersome due to network issues. However, with cryptocurrency payments facilitated by Blockchain, property purchases can be concluded within minutes, streamlining the transaction process.

3. Decentralization

In contrast to the centralized property acquisition process, blockchain operates as a decentralized system, eliminating the need for individuals, intermediaries, or governmental involvement. This streamlined approach minimizes the stress associated with lengthy procedures while ensuring robust property security.

4. Low cost

Furthermore, blockchain introduces cost-effectiveness. Through the liquidity options it provides, the blockchain system offers a variety of payment alternatives for property transactions, facilitating purchases within budget constraints.

How can blockchain be used for real estate management?

considering its growing influence across various sectors of our economy here’s how blockchain is reshaping the landscape of effective real estate management,

1. Smart contract

Utilizing blockchain technology in the real estate sector can bring significant advantages through the implementation of smart contracts. Already proven successful in financial and banking domains, smart contracts emerge as a leading and lucrative innovation within the blockchain realm. Given the constant handling of numerous transactions in real estate, smart contracts offer notable benefits.

With blockchain technology, property transactions, which involve too much paperwork, can now occur digitally and swiftly, involving only the buyers and sellers. This digital transformation ensures heightened transparency and security in transactions.

A pivotal aspect of smart contracts is their autonomy; they operate without the need for human interaction. Once all conditions are met, smart contracts self-execute and automate the transaction process. This not only reduces the involvement of individuals but also minimizes efforts, leading to cost savings and a diminished risk of AI-related fraud.

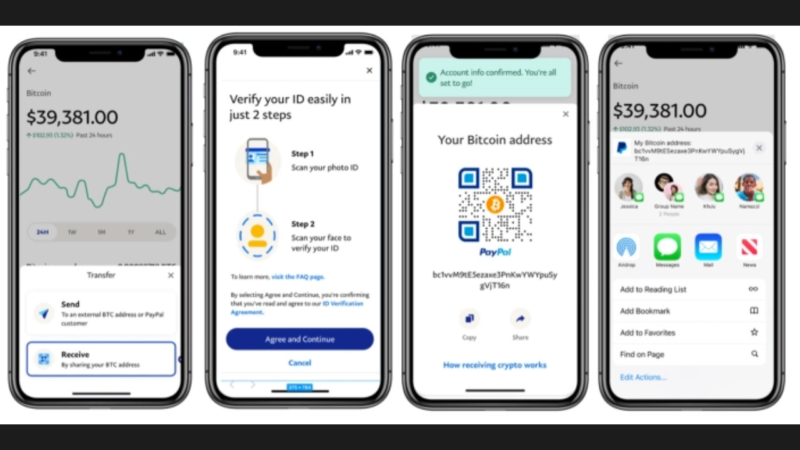

2. Tokenization

In commercial real estate, tokenization involves transforming real estate assets into digital tokens, which are subsequently traded on smart contract platforms. The details of a property are documented within a smart contract as digital tokens, and the property undergoes transfer once all prerequisites are satisfied.

Tokenizing real estate minimizes human interaction to the essential minimum. This method involves the development of ICO tokens or NFT tokens to secure the system against fraudulent activities. Real estate tokenization proves beneficial through fractional ownership, allowing multiple investors to partake in a single property. Additionally, the use of smart contracts contributes to lower transaction costs, enhancing the efficiency of tokenized real estate transactions.

3. Liquidity

Since blockchain in real estate enables property tokenization and fractional ownership, it can increase the liquidity of real estate assets, making them more affordable for a larger group of investors. Blockchain further contributes to liquidity rise by enabling cross-border transactions and mitigating issues like currency exchange rates and international payment systems. Consequently, properties that might otherwise be confined to local or national markets can attract international

In conclusion, integrating blockchain into real estate management offers enhanced security, faster transactions, lower costs, and increased liquidity. Features like smart contracts and tokenization revolutionize traditional processes, ensuring authenticity and transparency. Embracing blockchain is essential for a more efficient and inclusive future in real estate.